-

Capital base eroded by $4.5bn since 2005 – Apex bank source

-

Experts kick against regulatory-induced change

The recent devaluation of the naira against the United States dollar has sparked conversation on the urgency around the need to raise the capital base of commercial banks in the country, Daily Trust reports.

Some analysts have argued that the 2004 banking industry recapitalization, which increased banks’ capital base from N2 billion to the current N25 billion, had weakened.

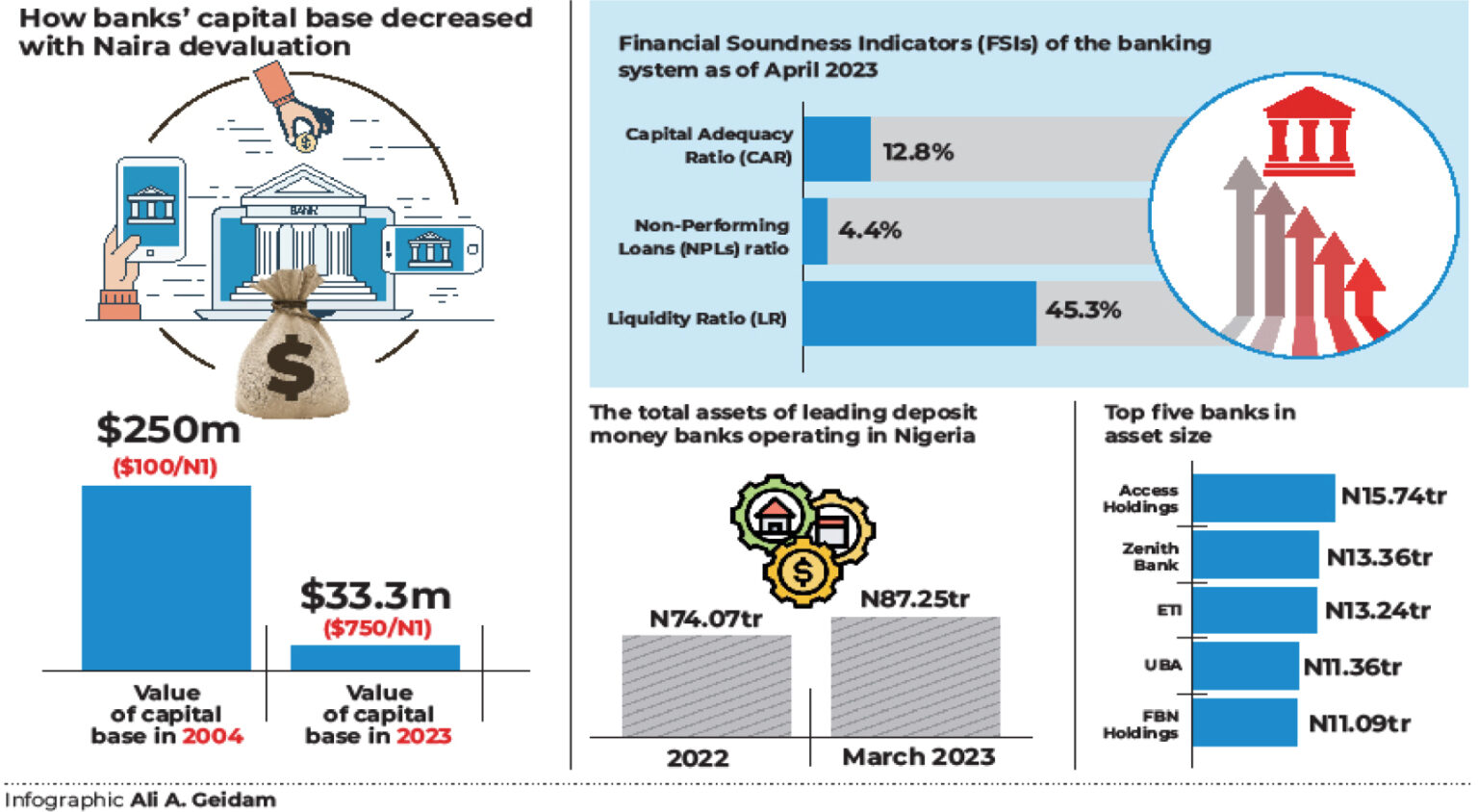

Analysis by this newspaper shows that N25 billion in 2004 exchange rate, which was about N100 saw the banks’ capital base in dollar terms average $250 million.

Today, if we relate N25 billion to N750, it is substantially lower to just $33.3 million.

Capital adequacy ratio is one of the important concepts in banking, which measures the amount of a bank’s capital in relation to the amount of its risk-weighted credit exposures.

The last monetary policy committee of the CBN held in May 2023, had noted the sustained stability in the banking system, evidenced by the performance of the Financial Soundness Indicators (FSIs).

It disclosed that the Capital Adequacy Ratio (CAR) of the banking system stood at 12.8 percent, Non-Performing Loans (NPLs) ratio at 4.4 percent, and Liquidity Ratio (LR) at 45.3 percent, as of April 2023.

Effort to get the reaction of the CBN was not successful as the spokesman of the apex bank, Dr Abdulmumin Isa, was said to be in a meeting. The essence was to find out whether they are planning to do recapitalization anytime soon, and what they think about the concerns being expressed about the banks’ capital base after massive naira depreciation from N100/$ in 2004 to N770/$ today.

Read more: https://dailytrust.com/naira-devaluation-nigerian-banks-heading-for-recapitalisation/